|

|

|

|---|

|

|

|

|---|---|---|

|

|

|

|

|

|

|---|---|---|

|

|

|

|

Understanding Chapter 13 Bankruptcy in Michigan: What You Need to Know

Chapter 13 bankruptcy is a legal process that allows individuals in Michigan to restructure their debts and establish a repayment plan over three to five years. This option is often chosen by those who have a regular income but are struggling to meet their financial obligations. By understanding the nuances of Chapter 13, you can make informed decisions about your financial future.

Eligibility for Chapter 13 Bankruptcy

To qualify for Chapter 13 bankruptcy in Michigan, certain criteria must be met. Firstly, the debtor must have a regular income. This is crucial as the repayment plan is based on your ability to pay over time.

- Secured debts must be less than $1,257,850.

- Unsecured debts must be less than $419,275.

- The debtor must have filed all required tax returns for the four years prior to the bankruptcy filing.

The Process of Filing

Filing for Chapter 13 involves several steps, starting with credit counseling from an approved agency. This step ensures you understand the alternatives to bankruptcy and helps develop a repayment plan.

Creating a Repayment Plan

The repayment plan is central to Chapter 13. It details how you intend to pay back creditors over the agreed period, usually three to five years. The plan must be feasible and is subject to court approval.

Court Involvement and Trustee Role

Once the plan is submitted, a bankruptcy trustee is appointed. The trustee oversees your case, ensuring payments are made to creditors as per the plan. The court will hold a confirmation hearing to approve the plan.

Benefits of Chapter 13 Bankruptcy

Filing for Chapter 13 offers several advantages:

- Debt Consolidation: It consolidates debts into a single payment, simplifying financial management.

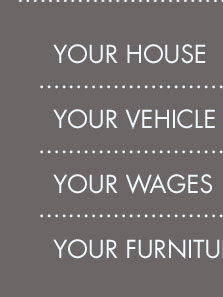

- Asset Protection: Unlike Chapter 7, you can keep your property while paying off debts.

- Co-signer Protection: Chapter 13 can protect co-signers from creditor actions.

It's important to consult with professionals, such as bankruptcy lawyers in Lancaster, Ohio, to explore how these benefits apply to your specific situation.

Common Challenges and Considerations

While Chapter 13 provides a pathway to financial recovery, it also has its challenges. Adhering to a strict budget for several years can be difficult. Additionally, failing to make payments could lead to the dismissal of your case, resulting in the loss of protection from creditors.

Understanding the Costs

Filing for Chapter 13 involves costs, including filing fees and attorney fees. These should be considered when determining if this bankruptcy option is feasible for you.

FAQ

-

What happens to my credit score after filing for Chapter 13?

Filing for Chapter 13 will impact your credit score, typically lowering it. However, as you adhere to the repayment plan, you can gradually rebuild your credit over time.

-

Can I apply for new credit during Chapter 13?

Generally, you must obtain court approval to incur new debt during Chapter 13. The court evaluates whether taking on additional credit is necessary and if it affects your ability to adhere to the repayment plan.

-

What happens if I miss a payment?

Missing a payment could lead to the dismissal of your case. It is crucial to communicate with your trustee to address any payment issues promptly.

-

Are there alternatives to Chapter 13?

Yes, alternatives include debt consolidation, negotiation with creditors, or filing for Chapter 7 bankruptcy. It's advisable to consult with professionals, such as bankruptcy lawyers in Dyersburg, TN, to explore all available options.

Checklist ; 10. Chapter 13 Plan, 14 days ; 11. Bankruptcy Petition Cover Sheet (Local Form), Required at filing ; 12. Certificate of Budget and Credit Counseling ...

Steps to Filing Chapter 13 Bankruptcy - File a petition to begin court protection against creditors. - Work with a legal professional to create a custom ...

Michigan Chapter 13 Bankruptcy Information. Under a chapter 13 bankruptcy, a debtor proposes a 3-5 year repayment plan to the creditors offering to pay off all ...

![]()